All About SIP

What is SIP?

A Systematic Investment Plan (SIP), more popularly known as SIP, is a facility offered by mutual funds to the investors to invest in a disciplined manner. SIP facility allows an investor to invest a fixed amount of money at pre-defined intervals in the selected mutual fund scheme. The fixed amount of money can be as low as Rs. 500, while the pre-defined SIP intervals can be on a weekly/monthly/quarterly/semi-annually or annual basis. By taking the SIP route to investments, the investor invests in a time-bound manner without worrying about the market dynamics and stands to benefit in the long-term due to average costing and power of compounding

Features of SIP investment plans

Systematic Investment Plan (SIP) is a very convenient route of investment in mutual funds for potential long term wealth creation. A systematic investment plan entails investing a fixed amount of money at regular intervals.. Besides a simplistic approach, it has several features given below.

- Rupee cost averaging

- A prominent feature that eliminates the need to worry about market fluctuations.

- When market prices are low, more mutual fund units are purchased with fixed SIP instalments.

- When market prices are low, more mutual fund units are purchased with fixed SIP instalments.

- Averages out the cost of purchasing over time.

- Disciplined and consistent investing

- The principle of systematic investing is simple as it works on regularity and periodicity.

- SIPs allow investors to contribute small sums regularly over an extended period.

- Payments can be weekly, monthly, or quarterly, promoting disciplined investment, thus enabling disciplined investment.

- Professional fund management

- SIP gives access to professionally managed mutual funds.

- Experienced fund managers make investment decisions based on in-depth research and market analysis.

- Long-term wealth creation through Compounding

- Gradual investment compounded over time.

- Maximizes potential returns for investors.

- Option to temporarily halt investments

- Flexibly investors can easily pause or cancel existing SIP or a start a new SIP with minimal restrictions.

- Investors can adjust based on their financial situation.

- Unrestricted investment ceiling

- Investors can start a SIP conveniently with any amount for there is no upper limit to the SIP amount

- Gradually increase investments as per their financial situation.

Benefits of SIP Investing

Power of Compounding

When you invest regularly through SIP and invest for the long term, the benefits are magnified by the compounding effect. Compounding effect ensures that you earn returns not only on your principal amount (actual investment) but also on the gains on the principal amount i.e. your money grows over time as the money you invest earns returns. And the returns also earn returns.

Power of Starting Early

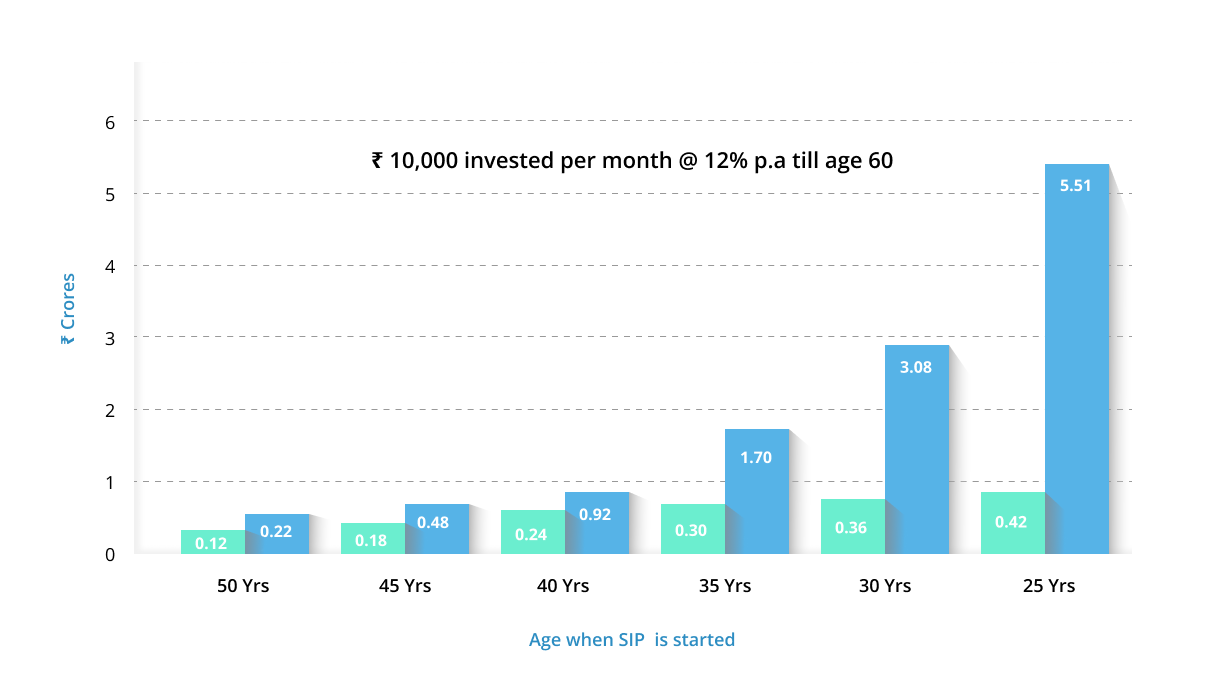

The earlier one starts saving and investing regularly, the easier it is to achieve your goals. The graph below shows the impact of beginning to invest Rs.10,000 monthly at various stages of life till the age of 60 years (assuming a return of 12% p.a.).

Source : Internal

Value of investment on Retirement

Amount invested via SIP

If you start SIP at age 30, as per the illustration shown a corpus of approximately Rs. 3 crores can be generated at retirement. If you would have waited 10 years and started SIP at age 40, a corpus of approximately Rs. 0.9 crore would have been available to you at retirement i.e. a difference of Rs. 2.1 crore – which is the ‘cost of delaying starting SIP’

What are types of SIP?

- Fixed SIP (Regular SIP)

A most simple and popular type of SIP. Investors can contribute fixed amount at specific regular intervals for a desired investment term period. The frequency of SIP can be set either weekly, monthly, quarterly or annually as per the investor’s convenience.

- Flexible SIP

A Flexible SIP option is similar to regular SIP option but still has a difference. It allows an investor the opportunity to increase or decrease the investment amount as per his or her financial situation. The regular contribution of the investor can be adjusted according to the cashflow. Sometimes, some fund houses even give an option to change the intervals as per the financial crunch.

The investor has to intimate to the fund houses for the change and should be communicated one week prior to the next due date of SIP.

- Perpetual SIP

In perpetual SIP an investor does not set a time period and regularly contributes till he or she decides to stop or modify. Initially one could do it indefinitely but recently from October 2023 National Automated Clearing House (NACH) has introduced a maximum term of 30 years for setting up SIP from the start date. It is now even mandatory to specify the collection date and will not be allowed perpetuity.

- Trigger SIP

A trigger SIP option allows investors to set triggers depending on when a specific event occurs in the market. It can be pre-defined trigger prompting, when the market suddenly dips or has a favourable condition, a specific index level or even a net asset value of the units. An investor can start a SIP, redeem units or switch to another plan. It is suitable for investors who understands the dynamic nature of the market as it is based on speculations.

- Step-up SIP (Top-up SIP)

A Step-up SIP provides investors facility to gradually increase their SIP instalment amount at a pre-determined rate at intervals. One can begin SIP with a fixed amount and opt for a regular top-up on it. It is good for people expecting annual increments or receiving bonuses. A investor can gradually increase the recurring contributions to the SIP with increased cash flow and it will help accumulate wealth corpus by parking more money.

- Value averaging investment plan (VIP)

A Value averaging investment plan is similar to conventional SIP where an investor makes higher investments when the market dips to buy more units. Though, it buys more when the market is low, it may result in higher returns, investors would require a lot of liquid cash with them to enrol for a VIP. This is because investors will have to make extra investments whenever there is a big fall the in the market. This lack of predictability is one of the main reasons why many average investors do not opt for VIP and is usually suitable for HNIs.

- Multiple SIP (Multi Select SIP)

It is a unique SIP offering that allows investor to invest across multiple mutual funds from one fund house with a single SIP facility. With one SIP, an investor can diversify the investment portfolio as the money is automatically distributed into multiple schemes. It also reduces the paperwork for managing multiple SIPs together.

Things to consider while starting SIP

- -Financial goals

Setting financial goals will provide a brief outline to investment journey. Buying a car, owning a home, children’s higher education, and retirement are the most common financial goals. Based on these an investor gets a starting point to begin financial planning. If one clearly identifies his or her goals, it becomes easy to determine the investment horizon and the amount required to invest through SIPs.

- -Risk appetite

Knowing about one’s risk tolerance levels can benefit an investor to make better investment choices. If one is comfortable with extreme ups and downs of the market, then choosing a pure equity fund should be a proper choice. While a risk averse investor will be having a conservative approach and will be comfortable with choosing debt funds. Understanding the risk appetite will help the investor select SIP funds that align with the comfort level.

- -Investment amount

The idea of SIP is to instil a disciplined approach to investment, hence the amount required to do SIP has to be affordable on regular basis. So, investors should choose an amount conveniently that will help in creating wealth to achieve the goal by being easy on the pocket.

- -Investment duration

The length of time an investor plans to stay invested matters. It directly impacts his/her ability to achieve financial goals. Choose an investment duration that aligns with the specific objectives. Longer durations provide more time to navigate market fluctuations and benefit from compounding.

How to invest in SIP through SBI Mutual Fund?

It is extremely easy and convenient to start a SIP though SBI Mutual Funds if all the documents are in order. In few steps given below an investor can invest either offline or online.

- Step 1 - Determine your investment objectives and then based on risk appetite choose a scheme according to your investment horizon.

- Step 2 - Make sure that you are KYC compliant

- Step 3 - Choose the date and the duration of the SIP.

- Step 4 - Choose the amount which you want to invest in the scheme along with setting up of frequency of SIP based on the cashflows.

- Step 5 - Start the SIP by submitting the form online or offline.

Goal based SIP Investing

We have many financial goals in life but do not know how to plan and invest for them. To plan your financial goals right, it is important to identify each goal in terms of a specific amount and the number of years that it will take to meet them. This is the essence of goal-based investing.

Know MoreTop Up SIP

This Top -Up in your SIP allows your investments to be in line with the increase in the cost of living or inflation and helps you plan for your financial goals right. It can also help you reach your financial goals earlier or create a larger corpus for your goal.

Helps save more in tandem with rising income – We expect our salaries or business income to rise annually by a certain percentage. If you Top-up your SIPs annually by the expected increase in your income, then it auto adapts to your rising income.

Frequently asked questions

What is the benefit of SIP?

Systematic Investment Plan (SIP) allows you to invest a fixed amount at regular intervals in a scheme. There are many benefits of investing in a SIP.

- Power of compounding - Investing in SIP allows the investor to take advantage of the power of compounding. Regular investments in a scheme leads to compounding which means you earn interest on your interest as it is added to the original amount. This is very beneficial for long term wealth creation.

- Rupee cost averaging - When an investor invests through SIP, he gets the benefit of rupee cost averaging. It means that the investor gets more units when the Net Asset Value (NAV) of the scheme is low and less units when the NAV is high. This brings down average cost of units over the long term.

- Flexibility - An investor has the flexibility to choose the amount, duration and the interval of the SIP. They also have the option to change the amount, pause or stop the SIP.

- Disciplined investing - Investment via SIP inculcates the value of disciplined investing in an investor as they are committed to investing a specific amount for a fixed period of time which is essential in long term wealth creation.

What is a SIP? How does it work?

A Systematic Investment Plan (SIP) is an investment tool which allows the investor to invest a fixed amount at regular intervals in a Mutual Fund scheme.

SIP works by investing a fixed amount at a defined frequency. With this an investor does not need to time the market and can invest in a hassle-free manner.

What is the minimum amount to invest in SIP?

The minimum amount an investor can invest in SIP may differ according to the scheme they want to invest in. For more information click on this link https://www.sbimf.com/en-us/investment-solutions or contact your financial advisor.

How to automatically renew the SIP?

To renew the SIP an investor has to fill a fresh form and start a new SIP and choose the desired duration.

Can you increase the duration of SIP?

An investor can start a fresh SIP and choose the desired duration by filling in a fresh SIP enrollment form, start a new SIP online or through Investap.

What happens if I miss an SIP installment?

Missing a SIP instalment does not lead to any penalty however missing 3 consecutive instalments leads to cancelling of the SIP.

What is Top up SIP?

Top up SIP is a facility which allows an investor to increase the amount of SIP instalments by a fixed amount at pre-determined intervals

What is power of compounding?

Power of compounding is a concept in which interest earned on the investment is reinvested which leads to compounding of interest and helps in long term wealth creation.

What is the difference between Top- up SIP and SIP?

Top up SIP is a facility in which an investor can increase the amount of SIP instalments by a fixed amount at pre-determined intervals whereas SIP is a facility in which a fixed amount is invested at pre-determined intervals.

What is meant by “Rupee Cost Averaging?

Rupee cost averaging is a concept which allows an investor to take advantage of the market volatility. By investing in a SIP, an investor gets more units when the Net Asset Value (NAV) is less and less units when the NAV is high. This brings down the average cost of the units over the long term.

An Investor Education and Awareness Initiative.

Investors should deal only with registered Mutual Funds, details of which can be verified on the SEBI website (https://www.sebi.gov.in ) under ‘Intermediaries/Market Infrastructure Institutions’. Please refer to website of mutual funds for process for completing one-time KYC (Know Your Customer) including process for change in address, phone number, bank details etc. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with their responses. SCORES facilitates you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Loading...