- Online Investment

- Offline Investment

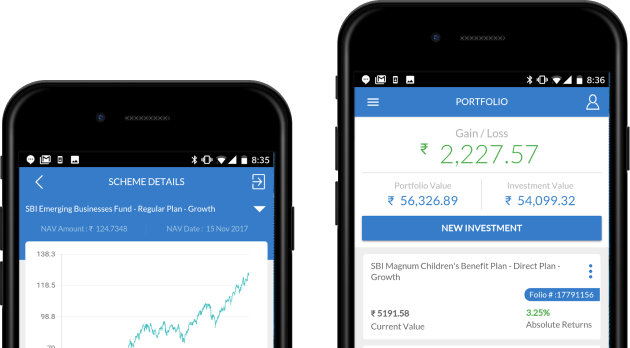

- m-Easy

- Partner Solutions

Online Mutual Fund Investing

The SBI Mutual Fund online portal is a quick, convenient and efficient tool that lets you carry out and manage your investments online, by offering a host of services and facilities.

Take a look at the features that make your online investments hassle-free

Get your KYC done

Secure and easy digital KYC simplifies the KYC procedure, making it easy for anyone to begin transacting. No documentation, no paperwork and no fuss! All you need is your PAN number and Aadhaar to register online. Click here to start your KYC Verification.

Plan & Invest

Shape your financial Goals with SBI Mutual Fund’s Investment Tools & Calculators. These tools do not just help in setting up a financial goal, but also offer potential solutions on how to meet your goals – be it making your first crore, saving tax each year, your dream vacation or your child’s education. Click here to get Started.

Get your Statement of Account

Get Details of all your active investments along with ‘Current Unit Balance’, ‘Current Valuation’, ‘Cost Value’. To get your statements, go to the home page, select I am an Existing Investor and click on ‘Get Statements’. Following statements are available – Account Statement, Capital Gains Statement & Smart Statement.

Non Financial Transactions

Update information registered against your folio with our Digital Non Financial Services. Update your phone number & E-mail ID on the go and digitally submit requests and documents to update other crucial information like bank account or nominees linked to a folio.

Personalised Dashboard

Your Customized page that gives you updates about your portfolio, your transactions, your watchlist and content curated exclusively for you basis your risk appetite. Login and Invest to View your ‘Personalized Dashboard’.

Instant Access Facility

Access your investments in SBI Liquid Fund within a very short period of time. The Instant Access Facility is exclusively available on the website and app. Investor’s can redeem upto 50,000 or 90% of the total invested amount instantly.

InvesTap

It’s a smart investor’s best friend

– anytime, anywhere.

Download the app now

Offline Mutual Fund Investment Process

Get started with these simple steps to begin investing offline with us

Step 1

Procure application and KYC form (if KYC procedure not completed) from website or any branch of SBI Mutual Fund or empaneled distributor office.Step 2

Fill the application/KYC (if applicable) form, provide necessary information i.e. name, address, PAN, email address, mobile number, etc. This email address and mobile number will be used for further communication, and can also be used to register for online transaction services.Step 3

Attach copies of relevant documents and submit them along with a cheque or demand draft of the desired investment amount.Step 4

Submit duly signed application/KYC (if applicable) form(s), with the cheque and all relevant documents, to any branch of SBI Mutual Fund or point of acceptance.Step 5

SBI Mutual Fund will then allocate and provide you a folio number for that particular investment. You will also receive an Account Statement, after the transaction is processed.Step 6

Contact a representative of SBI Mutual Fund or an empaneled distributor of SBI Mutual Fund.

M-Easy: A mobile Investment and SMS Alert Service By SBI

M-easy Mobile Investment Facility

Taking care of your investments and achieving your dreams is now easy. SBI Mutual Fund presents ‘m-Easy,’ a mobile investment facility which helps you Invest, Redeem and Switch from one scheme to another, via just an SMS. You can now manage your investments from any place, anytime.

How to Transact with M-Easy?

To perform a financial or non-financial transaction you need to send an SMS to “9210192101”. Click on link to view list of scheme and codes - Regular Schemes Direct Scheme

Registration is required for performing financial transactions. No registration is required to perform non-financial transactions.

Register for ‘m-Easy’ by filling in the Registration cum Debit Mandate Form. You can download the form by clicking on the appropriate link below.

Download m-Easy Mandate – Regular Schemes

Download m-Easy Mandate – Direct Schemes

For registration, scan and upload the duly filled and signed form along with a copy of your bank's cheque under the service request "mEasy Registration " in Non-Financial Transaction request page. No postage or physical submission of documents needed.

Click here to register measy online

Financial Transactions

SMS Keywords for Financial Transactions (Registration Required):

1) Invest

"INV space <Amount> " – Invest in your Default Scheme/Plan

"INV space <Amount> <Scheme Code> - Invest in a Particular Scheme / Plan

2) SIP

"SIP space <Amount>" – ITo Registe SIP in your Default Scheme / Plan

"SIP space <Amount> <Scheme

Code> - To Register SIP in a Particular Scheme / Plan

3) Redeem

"RED space <Amount>" – To Redeem your Default Scheme / Plan

"RED space <Amount / All> <From Scheme

Code> <To Scheme

Code> - To Switch

Non-Financial Transactions

SMS Keywords for Non-Financial Transactions (No registration required):

Portfolio Valuation

"VAL space <Scheme Code>" – Scheme / plan-wise valuation for all live folios

VAL space <Folio Number> - Scheme / plan-wise valuation

of the folio

"VAL" - Total valuation for all live folios

Details of last 3 processed

transactions

"TRX space <Scheme Code>" - Last three transactions processed in the scheme / plan.

"TRX space <Folio Number>" - Last three transactions processed in folio.

"TRX" - Last three transactions processed in all folios.

Latest NAV of a particular scheme/plan or all

scheme/ plans in a folio

"NAV space <Scheme Code>" Latest x NAV of the scheme / plan

"NAV space <Folio Number>" – Latest NAV of scheme / plans in the folio

Get statement of account of the folio (via e-mail

only , whenever registered)

"SOA space <Folio Number>" - Statement of Account for the folio will be sent through e-mail.

- Simple and convenient way to invest

- Facility to invest while on the move

- No paper work

- Instant confirmation of the transaction

| File name | Type | Size |

|---|---|---|

| Terms and Conditions M-Easy Mandate- Regular Schemes | 33 Kb | |

| Terms and Conditions M-Easy Mandate- Direct Schemes | 33 Kb |

| File name | Type | Size |

|---|---|---|

| Download M-Easy Mandate - Regular Schemes | 33 Kb | |

| Download M-Easy Mandate - Direct Schemes | 36 Kb |

What is m-Easy facility?

“m-Easy” facility enables investors (who have a registered folio with SBI Mutual Fund) to purchase/redeem/switch the units of a scheme by sending SMS from their mobile phone number registered with AMC. Investors can start using this facility only on receipt of registration confirmation from SBI Mutual Fund. Thereafter, investors can send SMS to 9210192101 and specify the amount with scheme code for purchase transaction; amount or ALL units for redemption/switch transaction.

Who are eligible to register for this facility?

This Facility is currently available for existing KYC complaint Individual investors (including guardians on behalf of minors) with ‘Single’ or ‘Anyone / Either or Survivor’ holding. The maximum transaction amount allowed through SMS is restricted to Rs. 1 Crore. This Facility is available with a condition that one mobile number can be registered with one folio and/or one folio can be registered with one mobile number only.

How do I register for this facilty? How many days will it take for mandate registration?

For registration, scan and upload the duly filled and signed form along with a copy of your bank's cheque under the service request "mEasy Registration" in Non-Financial Transaction request page. No postage or physical submission of documents needed. Click here to register online. The mandate registration will be done within a period of 30 days and investor can transact soon after the registration confirmation received from AMC.

What are the keywords and how to type the SMS?

SMS to be sent to 9210192101 with following keywords INV - for Purchase, RED for Redemption, SWT for Switch, HELP - For Keywords Example: To Invest in Default Scheme/Plan send an SMS saying INV space To Invest in Particular Scheme/Plan send an SMS saying INV space To Redeem in Default Scheme/Plan send an SMS saying RED space To Redeem in Particular Scheme/Plan send an SMS saying RED space To Switch send an SMS saying SWT space To Register SIP in Default Scheme/Plan send an SMS saying SIP space To Register SIP in Particular Scheme/Plan send an SMS saying SIP space For Help: HELP

What response will investor get after SMS delivered to designated number?

A receipt confirmation SMS will be sent to the investor.

Which are the eligible schemes/plans and SMS codes for SMS transactions?

“m-Easy” facility is available for various schemes. To view the list of schemes and codes, click here

What are the charges of SMS Transactions?

This service is free; however the outgoing SMS will be charged by your service provider in accordance with their tariffs.

What would be the applicable NAV?

The applicable NAV for the transaction will be based on the time of receipt (electronically time-stamped) of the SMS at AMC/CAMS and other factors as per scheme, the type of transaction, the amount, the time of realization of funds and cut-off time provisions of SEBI (Mutual Fund) Regulation, 1996. These transactions will be treated on par with similar transactions received through other modes.

Within how many days will the purchase amount be debited from investor’s bank account?

The bank account of the investor may be debited towards purchase within a period one to seven business days depending upon the clearing / ECS cycle for the location concerned. In case of non-receipt of the funds (for any reason), the transaction shall be cancelled and the units allotted, if any, would be reversed.

Can investor have one mobile number for more than one folio number?

This facility is available with a condition of 'One Mobile Number and One Folio Combination'. Only one mobile number can be registered with one folio and vice versa, for the purpose of this Facility. In other words, investors cannot register the same mobile number in more than one folio to avail SMS facility. However, it is clarified that other folios may have the same mobile number for receiving normal transaction alerts.

What will happen if investor sends an incorrect SMS?

Any mismatch in the SMS format as mentioned in point no. 4 would be rejected.

Can an investor send SMS from any number?

No, the SMS has to be sent only from the registered mobile number. If the SMS received from any other mobile, the SMS would be rejected.

Under what circumstances the transactions will not be processed?

Transactions will not be processed due to: Incomplete or incorrect information/key words/scheme code Non-receipt of the SMS message by the RTA Mobile network congestion and investor will not hold AMC/RTA responsible in such instances. The request for transaction to be considered as accepted, subject to realization of funds towards purchases and only on the receipt of the confirmation from RTA on the registered mobile number or Email ID of the investor.

Which are the empanelled banks for SMS service through direct debit?

HDFC Bank, Axis Bank, Bank of Baroda, Bank of India, Citibank, IDBI Bank, IndusInd Bank, Kotak Mahindra Bank, Punjab National Bank, State Bank of Bikaner & Jaipur, State Bank of Hyderabad, State Bank of India, State Bank of Mysore, State Bank of Patiala, State Bank of Travancore and Union Bank of India.

In which cities SMS transaction facility is available through ECS?

Agra, Ahmedabad, Allahabad, Amritsar, Anand, Asansol, Aurangabad, Bangalore, Bardhaman, Baroda, Belgaum, Bhavnagar, Bhilwara, Bhopal, Bhubaneshwar, Bijapur, Bikaner, Calicut, Chandigarh, Chennai, Cochin, Coimbatore, Cuttack, Davangere, Dehradun, Delhi, Dhanbad, Durgapur, Erode, Gadag, Gangtok, Goa, Gorakhpur, Gulbarga, Guwahati, Gwalior, Haldia, Hasan, Hubli , Hyderabad, Imphal, Indore, Jabalpur, Jaipur, Jalandhar, Jammu, Jamnagar, Jamshedpur, Jodhpur , Kakinada, Kanpur, Kolhapur, Kolkata, Kota, Lucknow, Ludhiana, Madurai, Mandya, Mangalore, Mumbai, Mysore, Nagpur, Nasik, Nellore, Patna, Pondicherry, Pune, Raichur, Raipur, Rajkot, Ranchi, Salem, Shillong, Shimla , Shimoga, Sholapur, Siliguri, Surat, Tirunelveli, Tirupati, Tiruppur, Trichur, Trichy, Trivandrum, Tumkur, Udaipur, Udipi, Varanasi, Vijaywada and Vizag.

Whether SMS will be accept during non business days?

Yes; however transaction will be processed as per applicable NAV.

How the distributor ARN Code would be recorded in the purchase/switch transaction?

Purchase/switch transactions under this facility will be processed with the following rules: If investor submits the mandate registration form with ARN Code and SMS sent for purchase/switch transaction with Regular Scheme Code, the transaction will be processed under Regular Scheme and the registered broker code will be captured in the transaction. If investor submits the mandate registration form with ARN Code and SMS sent for purchase/switch transaction with Direct Scheme Code, the transaction will be processed under Direct Scheme with “Direct” code. If investor submits the mandate registration form with ARN Code box “Blank” / “Direct” and SMS sent for purchase/switch transaction with Regular Scheme Code, the transaction will be processed under Direct Scheme with “Direct” code. If investor submits the mandate registration form with ARN Code box “Blank” / “Direct” and SMS sent for purchase/switch transaction with Direct Scheme Code, the transaction will be processed under Direct Scheme with “Direct” code.

Can an investor have a default Scheme/Plan/Option to invest in through m-Easy?

Yes, investor can mention the default scheme / plan / option for the Folio in the SMS Registration cum Debit Mandate form. This enables you to transact for that scheme, via SMS, without needing to mention the scheme code.

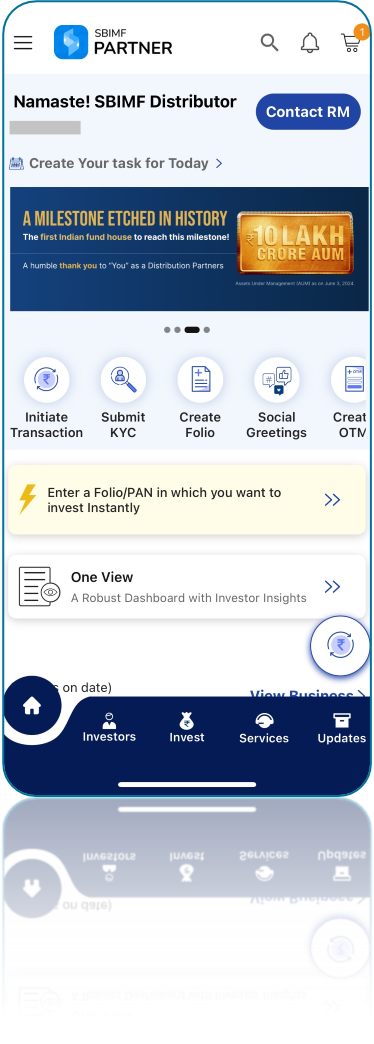

Partner Portal and Apps

SBI MF Partner - An investment App / Portal for Distributors

The whole new SBIMF Partner App is designed to provide the Mutual Fund Distributors with an effortless solution to manage various Mutual Fund accounts of their clients. It is a comprehensive Mutual Fund Distribution app that enables Mutual Fund Distributors (MFDs) to stay connected with their clients seamlessly. With the new SBIMF Partner App, MFDs can not only invest in Mutual Funds for their clients in the most effective manner without any paperwork but also manage their Transactions, Business, Meetings and Teams in a much better way. The key features of the app include –

- Online EmpanelmentSimply enter your details that are registered with AMFI and get empanelled with us within seconds

- IPV KYCOur easy IPV KYC process lets you get an edge in onboarding new clients and staying ahead by uploading documents properly and avoiding rejection

- Smart DashboardYou get Quick Action Widgets for better discoverability and Actionable Insights at your fingertips

- Edit SIPNow, no need to cancel and re-register the existing SIP separately. Use our Edit SIP functionality to make any modifications in the running SIPs

- Smart CheckoutThe Payment Mode gets auto-selected basis your past transactions for faster checkouts

And many more… Check out Now

Link to the Online Portal: partners.sbimf.com/

Loading...